WHERE HAVE ALL THE TRADIES GONE?

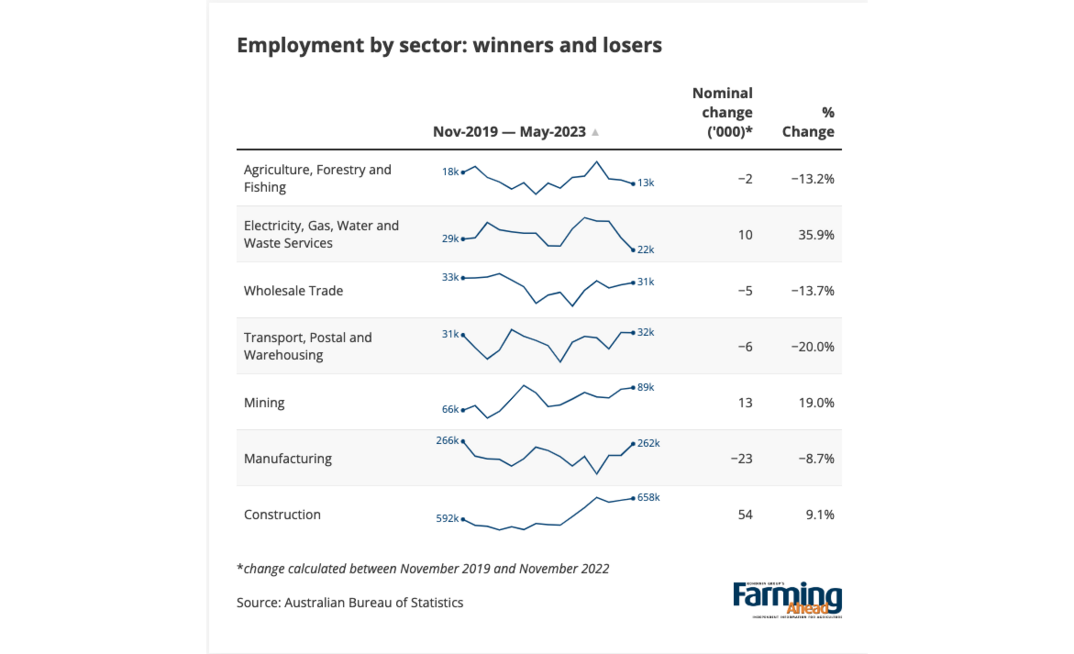

The Australian Bureau of Statistics (ABS) shows the number of technicians and trade workers Australia-wide increased from 1,819,900 in November 2019 (pre-covid) to 1,884,100 in November 2022, while the number of tradies working in the agricultural sector dropped by 13.2 per cent.

The data shows agriculture, forestry and fishing lost 2327 of its technicians and trades workers over this period and an additional 1832 workers from November 2023 to May 2023.

Meanwhile, the construction industry gained 54,048 tradies from November 2019 to November 2022 (up 9.1 per cent), mining attracted an additional 12,539 (up 19 per cent), and electricity, gas, water and waste services an extra 10,341 (35.9 per cent).

HOW MUCH HAVE TRADE SALARIES RISEN?

Seek insights shows salaries for trade workers have crept up considerably since pre-covid, mining companies are paying workers considerably higher than national average, and Western Australian tradies are getting paid the most.

The average salary of a technician working in the mining, resources and energy industry increased by 14 per cent from late 2019 to early 2022, according to Seek (based on average advertised salaries on its website).

Mechanics in manufacturing, transport and logistics, and those with a mechanical role in the trades and services industry, also received an average salary increase of 16 per cent from late 2019 to early 2022.

Australian mechanical technicians in the mining industry are getting paid $116,423 annually on average - almost 11 per cent higher than the national average for that trade, according to Seek salary comparisons.

The engineering industry is paying an average salary of $83,501 annually, with the trades and services industry paying $72,936 on average per year, revealing a significant pay gap between mining and other industries.

WHICH STATE IS PAYING THE MOST FOR TRADIES?

Unsurprisingly, Seek shows WA plant mechanics, diesel mechanics, heavy diesel mechanics, diesel fitters and mechanical fitters are all on a higher average salary than those in other states and territories.

WA diesel fitters are getting paid the most with an average salary range of $155,000 to $165,000, with heavy diesel mechanics in WA receiving a salary of $145,000 to $165,000, plant mechanics $130,000 to $150,000, diesel mechanics $120,000 to $140,000 and mechanical technicians $115,000 to $135,000.

The average upper range salary across all of these trades $151,000 in WA, compared to $114,000 in New South Wales, $107,000 in Victoria, $116,000 in Queensland, $124,000 in Tasmania, $123,000 in South Australia, $121,000 in Northern Territory and $120,000 in Australian Capital Territory, noting states and territories without sufficient data show national ranges.