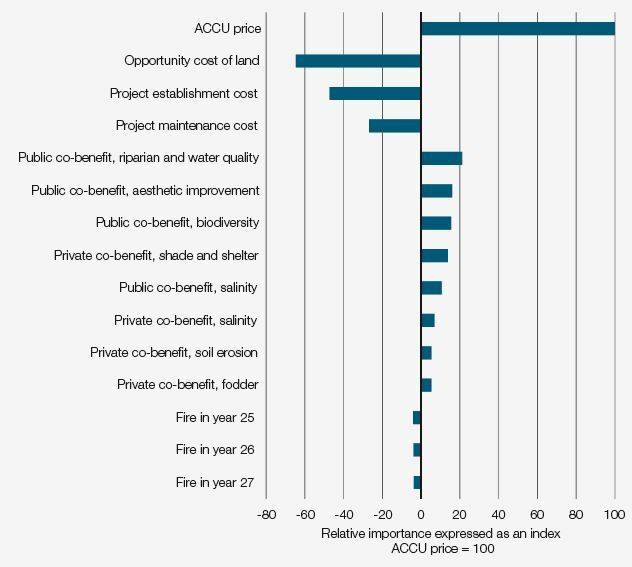

Figure 10.3 shows the relative importance of the different risk factors included in this illustrative risk analysis. Importance is expressed as an index in which the most important factor (the ACCU price) is set at 100 and the relative importance of other factors is expressed relative to that index.*

Note that some factors are positive while others are negative, reflecting the way that the factor contributes to net project benefits.

For example, an increase (decrease) in the ACCU price leads to an increase (decrease) in net benefits: there is a positive relationship between the two. In contrast, an increase (decrease) in the opportunity cost of land leads to a decrease (increase) in project net benefits: there is a negative relationship between the two.

Figure 10.3: Relative importance of different risk factors for a plantation-related project |

|

|

Data source: CIE calculations based on illustrative risk model.

10.5.1 The ACCU price

The most important factor contributing to risk is the ACCU price. As noted above, it is largely unknown, so a very wide range is included in the risk analysis. The options for managing ACCU price risk all involve particular economic trade-offs:

Hedging on international carbon markets. Project proponents could hedge price risk through transactions on international carbon markets. This is similar to the way some farm enterprises hedge exchange rate risk. However, this is a complex option and requires specialist advice.

Contract to an aggregator with a guaranteed price. While this option may allow price certainty, it comes at a cost: to be able to provide certainty, the aggregator is likely to offer a significantly discounted price. The farm enterprise would then need to consider whether the project is viable at the low (but certain) price.

Earn ACCUs now, but sell only when the price is transparent and within a target range. This option essentially creates a gap, in time, between paying the costs of earning the ACCUs and receiving revenues from them. The longer the gap, the higher the ACCU price would need to be to ensure that the project generates a return in present value terms.

10.5.2 The opportunity cost of land

The second most important factor emerging from the illustrative risk analysis is the opportunity cost of the land on which the project takes place. This is important for two reasons: first, because there is a wide range of values used within the analysis; second, because the opportunity cost of land is a cost factor for the entire life of the project and beyond (potentially for 100 years, depending on the permanence rules).

This is a factor that the farm enterprise has some control over. It can choose to operate the project on land with very low opportunity cost—particularly land that is unsuitable for other activities or that needs to be rehabilitated. There is still a trade-off, however, as low opportunity-cost land might also sequester less carbon.

10.5.3 Project establishment costs

In terms of risk, project establishment costs are about half as important as the ACCU price. These costs contribute to risk because they can vary widely and because they occur before any revenue or co-benefits accrue. They are large in present value terms.

This risk can be managed through careful project planning and appropriate on-farm expertise.

10.5.4 Project maintenance costs

In terms of risk, project maintenance costs are around a third as important as the ACCU price. They contribute to risk because they vary widely and because they continue for the entire project.

As for establishment costs, they can be controlled through careful project planning and appropriate on-farm expertise.

10.5.5 Public and private co-benefits

A range of public and private co-benefits contribute to overall project risk, although their contribution is relatively small compared to those of other factors.

However, the way this illustrative risk analysis has been constructed may understate the uncertainty about these benefits, viewed from the perspective of particular farm enterprises. You need to carefully consider the likelihood of co-benefits and the way they are valued by your farm enterprise.

For further reading on potential co-benefits the Queensland government has developed a set of information for participants in the state's Land Restoration Fund (LRF). The LRF Co-benefits Standard sets out how land managers can identify, measure and report on a range of priority co-benefits generated from an LRF project. Visit the LRF's "Verifying and valuing co-benefits" page here.

10.5.6 Fire risk

In this illustrative risk analysis, the risk of fire (leading to the need to re-establish plantings after Year 25) is relatively low compared to other risk factors. This is partly because this analysis assumes a low probability of fire and because the event occurs in the future and so is discounted significantly in present value terms. In many cases, fire is an insurable risk and can be dealt with by paying a premium.

A farm enterprise could also self-insure by putting aside some of the project proceeds in a fund that earns at least the farm's discount rate.

* In technical terms, the measure of the relative importance of risk is the effect of a one standard deviation change in an input variable on the standard deviation of the output variable. For our purposes here, relativities are presented as an index to illustrate the key points.

Explore the full Workshop Manual: The business case for carbon farming: improving your farm’s sustainability (January 2021)

Read the report

RESEARCH REPORTS

1. Introduction: background to the business case

This chapter lays out the basic background and groundwork of the manual

RESEARCH REPORTS

1.2 Being clear about the reasons for participating

Introduction: background to the business case

RESEARCH REPORTS

1.4 Working through the business case for carbon farming

Introduction: background to the business case

RESEARCH REPORTS

1.5 Factors determining project economics

Introduction: background to the business case

RESEARCH REPORTS

1.8 Important features of the business case

Introduction: background to the business case

RESEARCH REPORTS

2. How carbon is farmed under the ERF

This chapter considers in detail the activities that constitute carbon farming

RESEARCH REPORTS

2.5 Carbon farming under the Emissions Reduction Fund

How carbon is farmed under the ERF

RESEARCH REPORTS

3. The policy context and the price of ACCUs

This chapter takes a broad look at the policy context for carbon farming