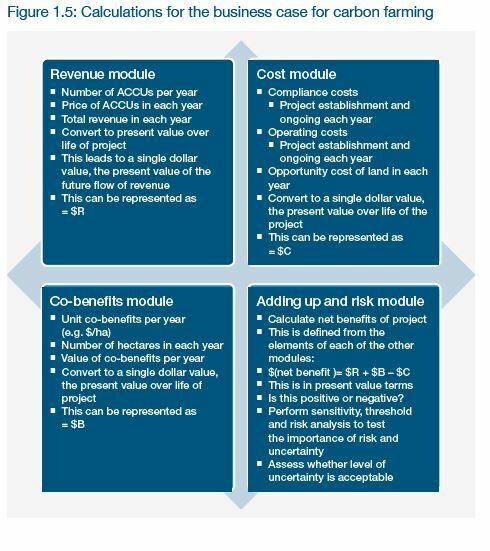

Figure 1.5 is a schematic showing how the business case for carbon farming can be built up. There are four modules to complete: a revenue module; a co-benefits module; a cost module; and an adding up and risk assessment module.

1.7.1 Present value calculations

The annual values of costs, revenues and co-benefits must be expressed in present value terms. The common approach of considering average annual gross margins is not really suitable for carbon farming, as the timing of costs and benefits can differ significantly and will vary from project to project.

For carbon farming projects, applying the ‘net present value rule' (illustrated later in this manual) is a more appropriate approach. When the present value of benefits and the present value of costs are compared, the project should go ahead only if the first exceeds the second when all the relevant costs and benefits, including co-benefits, are taken into account.

Working in present values requires the choice of a discount rate. This can be thought of as the rate of return that the farmer expects on the carbon farming investment. It can also be viewed as the opportunity cost of resources (financial and other) that are devoted to the carbon farming project. The choice of discount rate is an enterprise-specific decision, but at a minimum it should represent what the enterprise could earn, for example, if equivalent funds were placed into a secure long-term investment, such as government bonds.

For illustrative purposes, the calculations in this manual use a real 5% discount rate.

1.7.2 Risk analysis

However, the present value rule is not sufficient for a decision. The business case also needs to account for the risk associated with the carbon farming activity. A standard approach to issues of risk is to identify the risks, quantify them where possible, and develop strategies for risk mitigation. In the business case calculations, risk can also be examined by performing sensitivity analysis and threshold analysis of the estimated returns.

Sensitivity analysis tests the economic case for the project by varying underlying assumptions. The sensitivity of outcomes (the present value of net benefits) provides useful information about risks associated with the project.

Threshold or break-even analysis calculates particular thresholds for economic viability, such as the minimum ACCU price required to break even (that is, where the present value of benefits equals the present value of costs, the point at which the project earns the discount rate). Assessing the likelihood, or difficulty or ease, of achieving those thresholds provides further insight into project risks.

|

|

Explore the full Workshop Manual: The business case for carbon farming: improving your farm’s sustainability (January 2021)

Read the report

RESEARCH REPORTS

1. Introduction: background to the business case

This chapter lays out the basic background and groundwork of the manual

RESEARCH REPORTS

1.2 Being clear about the reasons for participating

Introduction: background to the business case

RESEARCH REPORTS

1.4 Working through the business case for carbon farming

Introduction: background to the business case

RESEARCH REPORTS

1.5 Factors determining project economics

Introduction: background to the business case

RESEARCH REPORTS

1.8 Important features of the business case

Introduction: background to the business case

RESEARCH REPORTS

2. How carbon is farmed under the ERF

This chapter considers in detail the activities that constitute carbon farming

RESEARCH REPORTS

2.5 Carbon farming under the Emissions Reduction Fund

How carbon is farmed under the ERF

RESEARCH REPORTS

3. The policy context and the price of ACCUs

This chapter takes a broad look at the policy context for carbon farming